Report Highlights. The average cost of college* in the United States is $36,436 per student per year, including books, supplies, and daily living expenses.

- The average cost of college has more than doubled in the 21st century, with an annual growth rate of 2% over the past 10 years.

- The average in-state student attending a public 4-year institution spends $26,027 for one academic year.

- The average cost of in-state tuition alone is $9,678; out-of-state tuition averages $27,091

- The average private, nonprofit university student spends a total of $55,840 per academic year living on campus, $38,768 of it on tuition and fees.

- Considering student loan interest and loss of income, the ultimate cost of a bachelor’s degree can exceed $500,000.

*In this context, college refers to any 4-year post secondary institution that offers an undergraduate degree program; this is the average cost to first-time, full-time undergraduates.

Jump to a state: AL | AK | AZ | AR | CA | CO | CT | DE | FL | GA | HI | ID | IL | IN | IA | KS | KY | LA | ME | MD | MA | MI | MN | MS | MO | MT | NE | NV | NH | NJ | NM | NY | NC | ND | OH | OK | OR | PA | RI | SC | SD | TN | TX | UT | VT | VA | WA | WV | WI | WY

| Institution Type | Cost of Tuition | Cost of Attendance** |

|---|---|---|

| 4-Year In-State | $9,678 | $26,027 |

| 2-Year In-State | $3,501 | $3,439 |

| Institution Type | Cost of Tuition | Cost of Attendance** |

|---|---|---|

| 4-Year Nonprofit | $38,768 | $54,840 |

| 4-Year For-profit | $17,825 | $32,895 |

| 2-Year Nonprofit | $17,735 | $33,007 |

| 2-Year For-profit | $15,637 | $27,214 |

**Cost of Attendance does not account for potential lost income nor student loan interest.

Related reports include Student Loan Debt Statistics | Average Cost of Community College | How Do People Pay for College? | Student Loan Refinancing

Average Total Cost of College

The cost of attendance (COA) refers to the total cost of tuition and fees, books and supplies, as well as room and board for those students living on campus. COA does not include transportation costs, daily living expenses, student loan interest, etc.

- The average cost of attendance for a student living on campus at a public 4-year in-state institution is $26,027 per year or $104,108 over 4 years.

- Out-of-state students pay $27,091 per year or $108,364 over 4 years.

- Private, nonprofit university students pay $55,840 per year or $223,360 over 4 years.

- While 4 years is the traditional period to earn a bachelor’s degree, just 40.4% of bachelor’s degree-seeking students graduate within that time.

- 96% of confirmed bachelor’s degree earners graduate within 6 years; the 6-year average cost of attendance is $156,162.

- Students unable to work full-time stand to lose a median annual income of $44,356.

- Student borrowers pay an average of $2,186 in interest each year, and the average student borrower spends roughly 20 years paying off their loans.

- Considering lost income and loan interest, the ultimate price of a bachelor’s degree may be as high as $509,434.

| Institution Type | Total Cost of Tuition | Total Cost of Degree† |

|---|---|---|

| 4-Year In-State | $26,027 | $156,162 |

| 2-Year In-State | $16,090 | $32,180 |

Institution Type Total Cost of Tuition Total Cost of Degree†

| 4-Year Nonprofit | $55,840 | $223,360 |

| 4-Year For-profit | $32,895 | $131,580 |

| 2-Year Nonprofit | $33,007 | $66,014 |

| 2-Year For-profit | $27,214 | $54,428 |

†Total Cost of Attendance does not account for potential lost income nor student loan interest.

Average Cost of Tuition

Tuition and fees make up the bulk of most college student’s educational expenses.

- The average cost of tuition at any 4-year institution is $19,806 or 54% of college costs.

- At public 4-year institutions, the average in-state tuition and required fees total $9,678 per year or 37% of the cost of attendance.

- Among private 4-year institutions, the average tuition and fees at a nonprofit college total $38,768 annually, which is equivalent to 69% of a student’s college costs.

- At for-profit institutions, tuition and fees average $17,825 annually, which is equivalent to 54% of the cost of attendance.

- The average cost of tuition and fees at any 2-year institution is $4,481 or 26.0% of the cost of attendance.

- At public 2-year institutions, or community colleges, in-district tuition and fees average $3,970 annually, which is equivalent to 24% of the cost of attendance.

- At private 2-year institutions, students pay $17,735 in annual tuition and fees to attend nonprofit schools; tuition is 53.0% of the cost of attendance.

- Private, for-profit 2-year colleges charge $15,637, which is 57% of the cost of attendance.

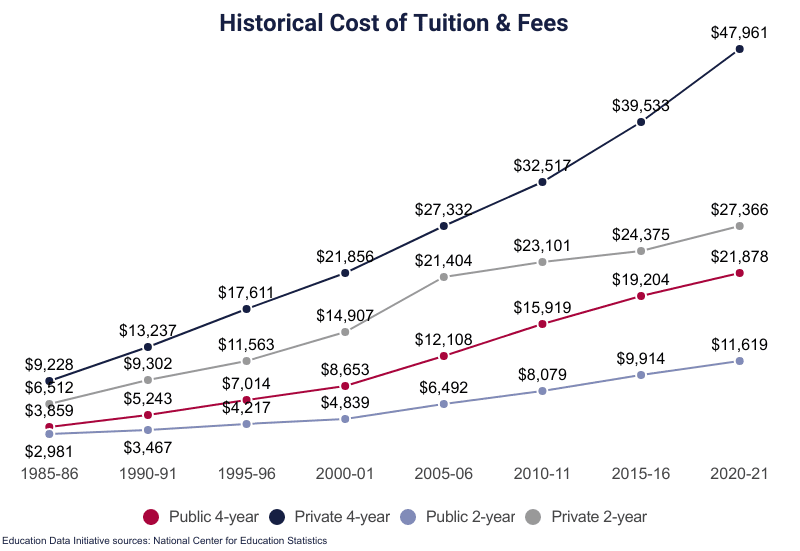

Historical Average Cost of Tuition

The cost of tuition has increased significantly over the last 40 years even after adjusting for inflation. See our report on College Tuition Inflation to learn more.

- In 1963, the annual cost of tuition at a 4-year public college was $243, which had the same buying power as $2,431.02 in September 2022 currency values.

- From 1963 to 2020, the cost of tuition increased by 2.5% per year after adjusting for inflation.

- Between 2010-11 and 2020-21, before adjusting for inflation, the average tuition increased 17% at 2-year colleges.

- During the same period, the average in-state tuition increased 45% at public 4-year institutions and 28% at private, nonprofit 4-year institutions.

- From 2000 to 2020, average post secondary tuition inflation outpaced wage inflation by 111.4%.

- In 1963, the cost of a 4-year-degree from a public university was $912.‡

- In 1989, the same degree cost $4,504.‡

As of the 2020-21 academic year, $19,372 is the price of a bachelor’s degree.‡

‡Cost of tuition and required fees assuming an in-state public institution attendee completes their bachelor’s degree program in 4 years.

Average Cost of Books & Supplies

Some programs require more expensive materials than others, so the cost of books and supplies varies widely. See our report on the Average Cost of College Textbooks for more.

- At public 4-year institutions, students pay an average of $1,216 annually for books and supplies.

- Books and supplies at private, non-profit institutions average $1,226; at private, for-profit institutions, the average cost is $1,035.

- At public 2-year institutions, students pay an average of $1,442 each year for books and supplies.

- At private, nonprofit institutions, books and supplies average $867; at private, for-profit 2-year colleges, the average cost is $1,416.

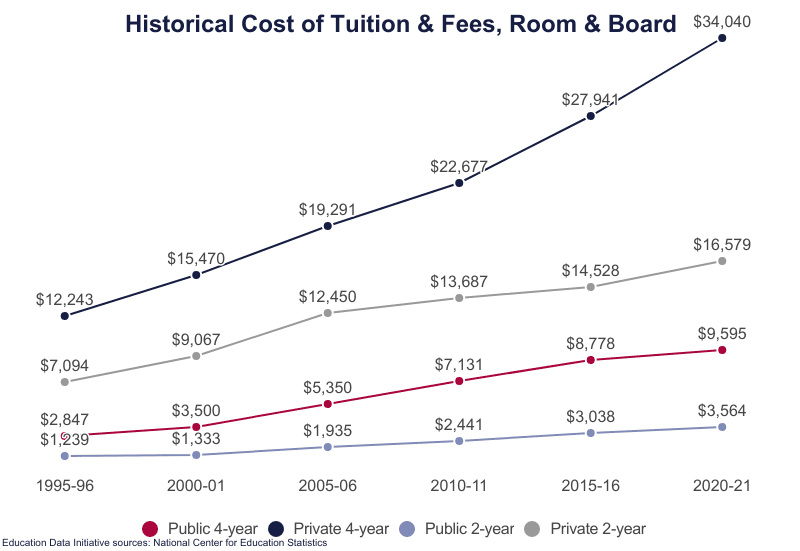

Average Cost of Room & Board

The determining factor in the cost of room and board is whether the student lives on or off campus.

- At 4-year institutions, the cost of room and board ranges is $12,111.

- At public 4-year institutions, students living on campus pay an average of $11,520 annually for room and board; off-campus boarders pay $11,365.

- At private, nonprofit institutions, on-campus boarders pay an average of $13,028 per academic year; students living off campus pay $11,269.

- At private, for-profit institutions, on-campus room and board average $32,895; students living off-campus pay an average of $8,543.

- At 2-year institutions, room and board costs range are $7,303.

- At public 2-year institutions, students living on campus pay an average of $7,063 for their annual room and board; students living off campus pay $10,229.

- At private, nonprofit 2-year colleges, on-campus boarders pay $11,720 annually; off-campus boarders pay $11,365.

- Private, for-profit institutions charge $9,136 on average for room and board; students living off campus pay $9,062.

| Institution | Location | Tuition |

|---|---|---|

| Columbia University in the City of New York | New York, NY | $61,671 |

| Bard College at Simon’s Rock | Great Barrington, MA | $61,169 |

| Franklin and Marshall College | Lancaster, PA | $61,062 |

| Vassar College | Poughkeepsie, NY | $60,930 |

| Amherst College | Amherst, MA | $60,890 |

| Colorado College | Colorado Springs, CO | $60,864 |

| Tufts University | Medford, MA | $60,862 |

| Brown University | Providence, RI | $60,696 |

| Reed College | Portland, OR | $60,620 |

| University of Chicago | Chicago, IL | $60,552 |

Average Additional Expenses

Necessary living expenses, such as transportation, personal care, and entertainment, may be included in the final total cost of college attendance. These expenses vary according to the local economy as well as the student’s housing status.

- Most tallies of college costs neglect to include the price of SAT prep courses, the most expensive of which can cost $5,000 or more.

- Additional expenses at 4-year institutions range from $3,304 to $4,551.

- Students living on campus at a public 4-year institution pay an average of $3,304 in additional annual expenses.

- Students who live off campus may expect to pay $4,551 if they do not live with family; for students living with family, additional expenses average $4,467.

- At private, nonprofit 4-year institutions, students living on campus spend an average of $2,818 on additional expenses.

- Students living off-campus alone or with non-family members spend $3,304 on additional living expenses; those living off-campus with family spend $4,467.

- At private, for-profit institutions, additional expenses average $5,268 for students living on campus.

- Students who live off campus spend an average of $4,506; those who live off campus with family spend $4,530.

- At 2-year institutions, additional expenses average between $3,562 and $4,498.

- Students living on campus at a public 2-year institution pay an average of $3,615 in additional annual expenses.

- Students living off-campus pay $4,433 in additional expenses; students living off-campus with family have an average of $4,450 in annual expenses.

- Students living on campus at 2-year private, nonprofit institutions pay an average of $2,684 in additional annual expenses.

- Students living off-campus alone or with non-family members spend $4,932, while students living off-campus with family members spend $5,084.

- Students at private, for-profit 2-year institutions spend an average of $1,026 on additional expenses if they live on campus.

- Students living off-campus spend $5,255 if they do not live with family members; students who live off-campus with family spend an average of $4,434.

| Institution | Location | Tuition |

|---|---|---|

| Turtle Mountain Community College | ND | $2,250 |

| Curtis Institute of Music | PA | $3,015 |

| Grace Mission University | CA | $3,120 |

| Sioux Falls Seminary | SD | $3,600 |

| Universidad Pentecostal Mizpa | PR | $4,220 |

| United Tribes Technical College | ND | $4,252 |

| Brigham Young University-Idaho | ID | $4,300 |

| Pacific Bible College | OR | $4,370 |

| Huntsville Bible College | AL | $4,560 |

| Universidad Ana G. Mendez-Online Campus | PR | $5,080 |

Average Cost of Lost Income

One of the largest expenses for students enrolled in college may be the loss of potential income in time spent studying instead of working.

- The median weekly income for a high school graduate is $853, or $44,356 per year.

- In four years, the average worker with a high school diploma may earn $177,424.

- The unemployment rate among high school graduates is 4%, which is 81% higher than the unemployment rate among bachelor’s degree holders.

- The unemployment rate among high school graduates is 27% lower than unemployment among workers who did not complete high school.

- 18- and 19-year-old students have an average unemployment rate of 10.6%; workers aged 20 to 24 years have an average unemployment rate of 6.3%.

Average Cost of Borrowing for College

Most students borrow money to attend college, later repaying the principal plus interest. All of these values compound the longer the student is in school.

- The average federal student loan debt is $37,787.38.

- Each year, 30.2% of students borrow money to pay for college.

- The average student borrows more than $7,200 to attend school.

See our reports on Student Loan Debt and How to Pay for College to learn more.

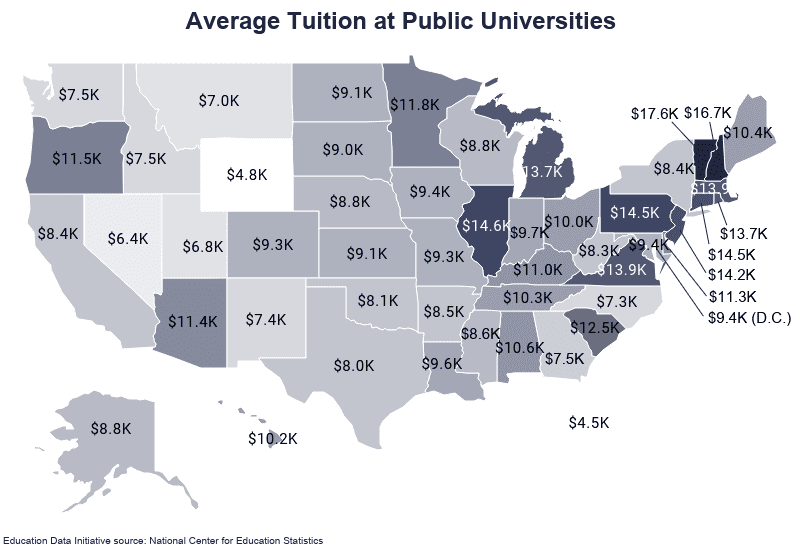

Average College Costs by State

The average cost of in-state tuition and fees varies from state to state and year to year. The range of difference is approximately $13,052.

- The most expensive public schools are in the Northeast, in and around what is traditionally called New England.

- Many of the most expensive private schools are also on the East Coast.

- The average tuition among the 10 most expensive states for public universities is $14,740.

- The least expensive schools are in the South and Plains regions; the least expensive private schools are also predominantly in the South.

- The average tuition among the states with the most reasonably priced public universities is $6,529.

For more information, see our report on the Average Cost of College by State.

| State | Tuition & Fees | Tuition + Room & Board |

|---|---|---|

| Vermont |

$17,593 |

$30,752 |

| New Hampshire |

$16,749 |

$29,222 |

| Illinois |

$14,579 |

$26,252 |

| Pennsylvania |

$14,532 |

$26,040 |

| Connecticut |

$14,487 |

$28,425 |

| New Jersey |

$14,184 |

$28,335 |

| Massachusetts |

$13,939 |

$28,317 |

| Virginia |

$13,931 |

$25,761 |

| Michigan |

$13,716 |

$24,777 |

| Rhode Island |

$13,697 |

$26,946 |

| South Carolina |

$12,544 |

$23,181 |

| Minnesota |

$11,836 |

$21,858 |

| Oregon |

$11,537 |

$24,517 |

| Arizona |

$11,410 |

$24,681 |

| Delaware |

$11,343 |

$24,862 |

| Kentucky |

$10,976 |

$22,317 |

| Alabama |

$10,617 |

$20,993 |

| Maine |

$10,377 |

$20,677 |

| Tennessee |

$10,271 |

$20,639 |

| Hawaii |

$10,197 |

$22,012 |

| Ohio |

$10,049 |

$22,860 |

| Indiana |

$9,656 |

$20,572 |

| Louisiana |

$9,656 |

$20,031 |

| Maryland |

$9,401 |

$22,380 |

| Iowa |

$9,373 |

$19,788 |

| Missouri |

$9,310 |

$19,394 |

| Colorado |

$9,269 |

$22,288 |

| Kansas |

$9,081 |

$19,082 |

| North Dakota |

$9,065 |

$18,057 |

| South Dakota |

$9,012 |

$17,177 |

| Alaska |

$8,849 |

$22,185 |

| Wisconsin |

$8,782 |

$17,875 |

| Nebraska |

$8,761 |

$19,352 |

| Mississippi |

$8,642 |

$19,221 |

| Arkansas |

$8,468 |

$18,262 |

| New York |

$8,416 |

$24,231 |

| California |

$8,401 |

$24,015 |

| West Virginia |

$8,252 |

$19,312 |

| Oklahoma |

$8,064 |

$17,283 |

| Texas |

$8,016 |

$18,325 |

| Georgia |

$7,525 |

$18,711 |

| Washington |

$7,485 |

$21,027 |

| Idaho |

$7,482 |

$16,518 |

| New Mexico |

$7,393 |

$17,113 |

| North Carolina |

$7,260 |

$17,113 |

| Montana |

$6,993 |

$16,931 |

| Utah |

$6,764 |

$14,653 |

| Nevada |

$6,434 |

$18,065 |

| District of Columbia |

$6,152 |

Unavailable |

| Wyoming |

$4,785 |

$14,584 |

| Florida |

$4,541 |

$15,543 |

| National Average |

$9,375 |

$21,337 |

Average State College Costs

Most public institutions receive funding from state and local governments. Colleges also receive federal funding through financial aid to students.

- Federal grants and contracts provide public post secondary institutions with 7.31% of their revenue.

- 4-year public institutions receive 7.65% of their revenue from federal grants and contracts.

- Federal grants and contracts pay for 4.69% of 2-year public institutions’ revenue.

- State governments fund an average of 1.89% of public post secondary revenue.

- 16.28% of revenue comes from tuition, some of which is federally subsidized.

For more on education spending, see our report on U.S. Public Education Spending.

Analysis: Room and Board On and Off Campus

Living expenses are the second-largest cost of college after tuition and fees. Whether it is less expensive to live on or off campus depends on local rental markets. Colleges do not always accurately represent off-campus living costs, either.

Stanford University lists average local rent prices from 2018 on its student housing website. According to Stanford, one (1) year in a shared 2-bedroom apartment within the San Francisco-San Jose urban sprawl would cost each student between $19,000 and $17,770. Room and board on campus costs between $16,796 and $18,784 for an academic year.

The University of California-Berkeley, meanwhile, estimates that students pay up to 106% more living in an on-campus residence hall than they do in an off-campus apartment. This estimate, however, makes a number of assumptions regarding personal expenses, including health insurance, and the average local rent. UC estimates students pay roughly $19,000 for apartment rental.

Such discrepancies can make budgeting difficult. Furthermore, other expenses that add to the cost of living vary from market to market. Groceries purchased in Iowa are much less expensive than groceries in Manhattan’s Lower East Side. Students may be able to temporarily reduce their cost of living using financial aid. Using student loans for living expenses, however, ultimately increases the student’s loan debt, including interest.

Sources

- NCES, Integrated Postsecondary Education Data System (IPEDS)

- National Center for Education Statistics (NCES), Digest of Education Statistics

- U.S. Bureau of Labor Statistics, Career Outlook

- New America, In the Interest of Few

- Forbes, Private Student Loan Interest Rates

- CNBC, This is The Average Age When People Finally Pay Off Their Student Loans for Good

- One Wisconsin Now, Twenty to Life: Higher Education Turning into Multi-Decade Debt Sentence

- BLS, Consumer Price Index Inflation Calculator

- Social Security Administration, National Average Wage Index

- U.S. Department of Education (ED) College Affordability and Transparency Center

- Stanford University, Community Housing: Housing Types and Costs

- PayScale, Cost of Living Calculator

- University of California – Berkeley, Student Budgets (Cost of Attendance)

- BLS, Labor Force Statistics from the Current Population Survey

- ED Office of Federal Student Aid, Federal Student Loan Portfolio