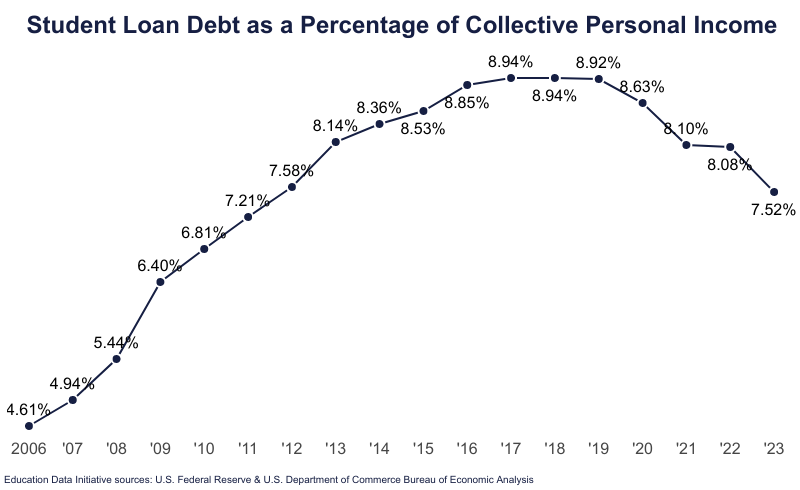

Report Highlights. Student loan debt in the United States totals $1.777 trillion; annual growth resumed in 2024 following a year-over-year (YoY) decline in 2023.

- The outstanding federal student loan balance is $1.693 trillion; 42.7 million student borrowers have federal loan debt.

- Federal student loan debt represents 92.2% of all student loan debt; 7.79% of student loan debt is private, including $29.3 billion in refinance loans.

- The average federal student loan debt balance is $38,375, while the total average balance (including private loan debt) may be as high as $41,618.

- 4.86% of federal student loans dollars were in default as of 2024’s fourth financial quarter (2024 Q4); 1.61% of private student loans were in default as of 2024 Q1.

- The average public university student borrows $31,960 to attain a bachelor’s degree.

Related reports include Total Student Loan Debt | Average Student Loan Debt | Student Loan Forgiveness | Student Loan Default Rate | Average Student Loan Payment | Student Loan Refinancing

| Quarter | Total (in millions) |

YoY Change |

|---|---|---|

| 2024 Q4 | $1,777,101.97 | 2.77% |

| 2024 Q3 | $1,772,891.41 | 2.33% |

| 2024 Q2 | $1,741,137.84 | -1.14% |

| 2024 Q1 | $1,753,333.67 | -1.22% |

| 2023 Q4 | $1,729,139.13 | -1.98% |

| 2023 Q3 | $1,732,575.34 | -1.66% |

| 2023 Q2 | $1,761,243.55 | 0.99% |

| 2023 Q1 | $1,774,909.90 | 1.57% |

| 2022 Q4 | $1,764,067.41 | 1.28% |

| 2022 Q3 | $1,761,742.00 | 1.28% |

| 2022 Q2 | $1,744,007.00 | 1.45% |

| 2022 Q1 | $1,747,455.51 | 1.67% |

| 2021 Q4 | $1,733,415.18 | 2.34% |

| 2021 Q3 | $1,739,443.83 | 2.53% |

| 2021 Q2 | $1,719,067.51 | 2.78% |

| 2021 Q1 | $1,718,706.56 | 2.80% |

2024 Student Loan Debt Statistics

While the first half of 2024 total student loan debt balance continued the annual decline that began in 2023 Q4 growth was the highest since 2021 Q3.

- National student loan debt increased 2.77% YoY in Q4 of 2024; federal student loan debt increased 2.27%.

- Private student loan debt totaled $138.502 billion, approximately $27.4 billion (19.8%) of which is refinance loan debt.

- 2024 Q3 had the first YoY increase in national student loan debt since 2023 Q2.

- Federal student loan debt saw its largest YoY in 2024 Q1 (down 2.26%).

- Total student loan debt increased $47.962 billion in 2024.

- Federal student loan debt increased $36.40 billion, representing 75.9% of the YoY increase in all student loans, federal and private.

2023 Student Loan Debt Statistics

For the first time ever, the total student loan debt declined from one year to the next (from 2022 to 2023).

- National student loan debt declined 1.98% YoY in 2023 Q4.

- 2023 Q4 was only the second quarter ever in which student loan debt declined YoY; the first was 2023 Q3, when student loan debt declined 1.66%.

- From 2023 Q1 to 2023 Q4, the national student loan debt balance declined 2.58%.

- In 2023 Q3, Federal student loan debt declined by 0.65%.

- Also in 2023, 92.8% of all student loan debt was federal; 7.2% belonged to private borrowers.

- Federal and private student loan debt combined decreased by $34.9 billion in 2023.

- Also in 2023, federal student loan debt alone decreased $32.3 billion.

2020s Student Loan Debt Statistics

While the total student loan debt balance to grew in 2022, its annual growth rate was slower than the previous decade.

- Between 2020 Q1 and 2023 Q1, student loan debt accumulation decreased by an average quarterly rate of 31.4%.

- The total national student loan debt increased 1.66% YoY in the fourth financial quarter of 2022.

- From 2022 Q1 to 2022 Q2, the national student loan debt balance declined 0.12%; this is 106% lower than the average quarterly change since the first financial quarter of 2006.

- Also in 2022 Q2, 92.8% of all student loan debt was federal; 7.2% belonged to private borrowers.

- In 2023 Q2, federal student loan debt declined 0.15%.

- Federal student loan debt declined 0.27% in 2022 Q1; this is the most significant quarterly decline in at least a decade.

- The average federal debt increased $119.94 in 2022 Q3.

- The federal share of the total student loan debt balance increased 3.44% from 2017 Q2 to 2023 Q2.

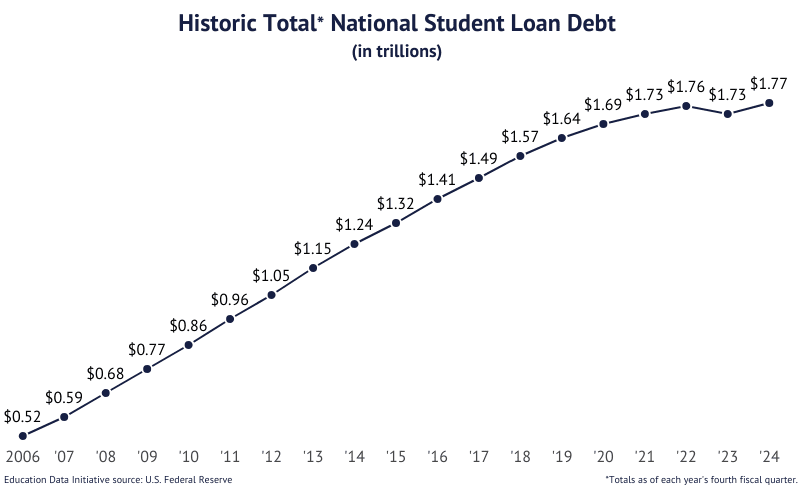

| Year* | Total (in millions) |

YoY Change | 2024 | $1,777,101.97 | 2.53% |

|---|---|---|

| 2023 | $1,729,139.13 | -1.98% |

| 2022 | $1,764,067.41 | 1.77% |

| 2021 | $1,733,415.18 | 2.34% |

| 2020 | $1,693,860.24 | 3.42% |

| 2019 | $1,637,880.70 | 4.53% |

| 2018 | $1,566,903.43 | 5.24% |

| 2017 | $1,488,895.48 | 5.95% |

| 2016 | $1,405,332.16 | 6.44% |

| 2015 | $1,320,248.14 | 6.84% |

| 2014 | $1,235,751.47 | 7.87% |

| 2013 | $1,145,550.75 | 8.63% |

| 2012 | $1,054,565.11 | 9.87% |

| 2011 | $959,823.95 | 12.2% |

*Total student loan debt balance as of each year’s fourth fiscal quarter.

Student Loan Debt Relief Statistics

Federal student loan interest was 0.0% for most federal loans until after August 31, 2023.

- 55% of Americans support cancellation of up to $10,000 per borrower in federal student loans; 47% support cancellation of up to $50,000 per borrower.

- 33.4% of student borrowers owe $10,000 or less in federal debt; 76.4% owe $40,000 or less.

- 31% of Americans oppose student loan debt cancellation.

- Among those identifying themselves as “liberal,” 78% support student loan forgiveness.

- Among those identifying as “conservative,” 39% support student loan forgiveness.

- Those who strongly support up to $10,000 student loan forgiveness are 20% more likely to be female than male.

- 56.0% of those who strongly support student loan forgiveness make less than $50,000 annually; 14.3% make over $100,000.

- In May of 2020, 9% of borrowers who attended public institutions were behind on their student loan payments.

- 7% of borrowers who attended private, nonprofit institutions and 24% of borrowers who attended private, for-profit schools were behind on their loan payments.

- By July, 11.2% of adults with student loan debt reported they were unable to make at least one student loan payment that year-to-date.

- In early 2020, 75.3% of private student loans were in repayment while 20% were in deferment.

- While many private lenders offered suspension in payments of up to 3 months, few (if any) deferred interest.

Student Loan Borrower Statistics

Student loan debt is now the second-highest consumer debt category after mortgages.

- 20% of all American adults with undergraduate degrees have outstanding student debt; 24% postgraduate degree holders report outstanding student loans.

- 20% of U.S. adults report having paid off student loan debt.

- The 5-year annual average student loan debt growth rate is 1.66%.

- The average student loan debt growth rate outpaces tuition costs, with tuition and fees declining by 0.72% over five (5) years.

- In a single year, 28.6% of undergraduate students accepted federal loans.

- 40% of borrowers with outstanding debt related to their own education owe a balance on a student loan; 5% of borrowers owe for a child or grandchild’s education.

- 28% of borrowers who borrowed for their own education have a student loan debt balance of less than $10,000.

| Year | Total (in billions) |

YoY Change |

|---|---|---|

| 2024 Q4 | $1,638.60 | 2.27% |

| 2024 Q3 | $1,611.00 | -1.40% |

| 2024 Q2 | $1,620.10 | -1.48% |

| 2024 Q1 | $1,598.40 | -2.26% |

| 2023 Q4 | $1,602.20 | -1.98% |

| 2023 Q3 | $1,633.80 | 1.02% |

| 2023 Q2 | $1,644.50 | 1.53% |

| 2023 Q1 | $1,635.40 | 1.81% |

| 2022 Q4 | $1,634.50 | 1.48% |

| 2022 Q3 | $1,617.30 | 1.65% |

| 2022 Q2 | $1,619.70 | 1.75% |

| 2022 Q1 | $1,606.40 | 2.63% |

| 2021 Q4 | $1,610.70 | 2.83% |

| 2021 Q3 | $1,591.10 | 3.00% |

| 2021 Q2 | $1,591.80 | 3.18% |

| 2021 Q1 | $1,565.20 | 3.31% |

| 2020 Q4 | $1,556.30 | 3.71% |

| 2020 Q3 | $1,544.80 | 4.30% |

| 2020 Q2 | $1,542.70 | 4.48% |

| 2020 Q1 | $1,515.00 | 4.69% |

Federal Student Loan Debt

About half of undergraduates borrow money from the federal government.

- 53.3% of undergraduate program completers use federal loans at some point.

- 54.7% of federal student loan debt is in Stafford Loans.

- 18.0% of federal debt is in subsidized Stafford loans; 36.7% is in unsubsidized Stafford loans

- 31.6% of federal student loan debt is in direct consolidated loans.

- 6.7% of student loan debt is from Parent PLUS loans borrowed by parents on behalf of their children.

- 6.8% of student loan debt is from Grad PLUS loans going to graduate or professional students.

- 0.2% of student loan debt is from Perkins loans.

- The federal government loans an annual total of $87.2 billion to all postsecondary students (including graduate and professional students).

- 28% of undergraduate students borrow federal loans.

- 61% of graduate students borrow federal loans.

Private Student Loan Debt

Private loan borrowing usually represents less than 10% of all student loan debt.

- The national private student loan balance was $133.4 billion as of 2024 Q1.

- 90.70% of that balance was for undergraduate loans while 9.3% was for graduate student loans.

- 19.33% of private student debt was in deferment; a further 1.86% was in forbearance.

- 2.91% of private student loans were in a grace period.

- Loans with co-signers account for 92.45% of private undergraduate student debt; graduate students use co-signers for 68.46% of their loan dollars.

Other Educational Debt

Student loans are designed to only cover certain educational costs. Many students borrow money from other sources to pay for living expenses incurred during their time in college or other school-related expenses their student loans don’t cover.

- 24% of indebted student borrowers have debt related to their education besides student loan debt.

- 4% of indebted borrowers used a home equity loan to pay for their own education; 11% used some other type of loan to pay for their own education.

- 9% of indebted borrowers who borrowed to fund a child or grandchild’s education used home equity loans and 11% used another type of loan.

Student Loan Debt Among Demographics

Detailed demographic reports include Student Loan Debt by State and by Graduation Year.

- 48.2% of independent undergraduate students accepted federal student loans.

- Middle-income students are most likely to take out federal loans at 50.8%.

- 57.4% of students living in campus housing use federal loans.

- 31.1% of college students living with their parents accept federal loans.

- 41.7% of married undergraduates accepted federal student loans.

Student Loan Debt by Sex or Gender

For more detailed research, read our report on Student Loan Debt by Gender.

- 49.3% of female bachelor’s degree holders accept federal student loans.

- 41.9% of male bachelor’s degree holders accept federal loans.

- Among associate’s degree holders, female students are 16.0% more likely to borrow federal student loans than their male peers.

- Female bachelor’s degree holders borrow 3.63% more in student loans than male bachelor’s degree holders.

- Female associate’s degree holders borrow 14.2% more student loans than their male counterparts.

Student Loan Debt by Race or Ethnicity

For more detailed research, read our report on Student Loan Debt by Race.

- Among bachelor’s degree holders, Black students are the most likely to borrow federal loans at 82.9%.

- Four years after graduation, Black or African American student borrowers owe $25,000 more than white or Caucasian borrowers owe for bachelor’s degrees.

- On average, Black or African American student borrowers owe $3,800 more than white or Caucasian borrowers.

- Four years after graduation, 48% of Black student borrowers and 17% of White student borrowers owe more than they initially borrowed.

- Among graduate students, 40% of Black students and 22% of White students accumulate debt for graduate school.

Student Loan Debt by Age

For more detailed research, read our report on Student Loan Debt by Age.

- 25% of adults aged 18 to 29 years report having student loan debt.

- Among 30- to 44-year-olds, 14% report student loan debt.

- 15.1% of indebted federal student loan borrowers are under the age of 25 years.

- 33.5% of federal borrowers are between the ages of 25 to 34.

- 6.3% of federal borrowers are 62 years of age and older.

- The average 62-year-old federal borrower owes $42,780 in federal educational debt, including Parent PLUS loans.

- Federal borrowers under 25 years old each owe an average $14,160.

- Borrowers between the ages of 25 and 34 years have an average debt of $33,260.

Student Loan Debt by Educational Attainment

Borrowers with higher levels of education are more likely to have higher student loan debt balances.

- Among those with an associate’s degree as their highest level of education, $20,340 is the average federal student loan debt.

- Bachelor’s degree attainers have an average federal student loan debt is $29,550.

- The average graduate degree holder owes up to $102,790 in cumulative federal student loan debt.

- 54.0% of all graduate school completers have federal student loan debt; 48.2% have debt from their graduate studies.

- Among master’s degree holders, 55.2% have any federal student loan debt while 49.1% owe for graduate school.

- Among those with professional doctorates, 74.8% have any federal student loan debt; 73.0% owe for graduate school.

- Doctors of Medicine are the most likely to have student loan debt; 76.2% owe any student loan debt while 74.5% have unpaid loans from graduate school.

- The average graduate student owed $82,810 in total federal loan debt in 2016; inflated to June 2023 dollars, this is equivalent to $104,150.

- Loan debt from graduate school totaled $70,980 among graduate degree holders in 2016; inflated to June 2023 dollars, this is equivalent to $89,270.

Student Loan Debt Inflation

While the national student loan debt balance has increased fairly consistently, the rate of increase has been in decline for years; some of this is likely due to fewer students each borrowing smaller amounts.

- In 2006, the total federal student loan balance was $480 billion, or 29.3% of the current balance.

- Between 2006 and 2023, the total federal student loan debt balance increased 267.1%, which is an annual rate of 15.7%, or a quarterly rate of 3.82%.

- From 2010 Q1 to 2020 Q1, the quarterly rate of increase declined 91.0%.

- In the last decade, the total student loan debt balance has increased at an average quarterly rate of 1.3%.

- Between the 2009-10 and 2019-20 academic years, 18% fewer students borrowed federal loan dollars.

Student Loan Forgiveness Statistics

The process of student loan forgiveness appears to be muddled by ambiguous processes and errors. Borrowers are often unaware of actually being eligible for student loan forgiveness. Additionally, borrowers who should be eligible have been denied because of negligence or misinformation by their loan servicer.

- 3.3% of applications for Public Service Loan Forgiveness have been approved since the program’s inception.

- As of April 2018, only 0.28% of PSLF applications had been approved.

- At least 3.72 million indebted student loan borrowers are eligible for PSLF based on their employment status.

- The average debt balance among eligible borrowers is $88,260.

- A total of $46.8 billion in federal student loans have been forgiven through PSLF.

- Up to 10,100 teachers have successfully had their student loan balances partially or totally forgiven through the Teacher Loan Forgiveness Program.

- A total of $197.3 million in federal student loans have been forgiven through Teacher Loan Forgiveness.

- $1,073 per indebted student borrower is roughly the rate at which the federal government forgives student loans.

For more detailed research, view our report on Student Loan Forgiveness Statistics.

Federal Student Loan Debt Freeze

Introduced between the second and third financial quarter of 2020, the CARES Act offered student loan debt relief that affected an estimated 35 million borrowers.

- Between 2020’s 2nd and 3rd financial quarters, the amount of student loan debt in repayment decreased 82% while student debt in forbearance increased 375%.

- Between the 3rd and 4th financial quarters, student loans in forbearance declined 0.44%.

- Also during that period, the number of loans in repayment grew 33.3%.

- The number of loans in default also declined by 1.79%.

- 65.8% of all debt from federal student loans remained in forbearance until September 2023.

- 26.7 million or 61.2% of borrowers had loans in forbearance.

- 300,000 or 0.69% of federal student loan borrowers had loans in repayment.

- 6.91% of the student loan debt balance belonged to students who are still in school.

- 1.12% of the total federal student loan debt was in a grace period.

- 6.17% of federal debt was in defaulted loans.

Report: Student Debt Scams on the Rise

In late-2020, media outlets began reporting increased complaints about student loan debt scams. Such reports are not uncommon during desperate times (read: carpetbagger), and as long as there is a student debt crisis, the scams will continue.

Common scams include promises of debt forgiveness, as well as bogus refinancing and consolidation offers that include excessive up-front fees (see our special report on student loan refinancing to find out how to legitimately refinance your student loan debt with no additional fees).

The U.S. Department of Education warns that they will never ask you for your FSA ID password. Your FSA ID is like an electronic signature, which you use to sign legally binding documents electronically. Never give your FSA ID password to anyone or allow anyone to create an FSA ID for you.

If you suspect you have been scammed, complete the following steps in order:

- Change your FSA ID immediately.

- Contact your student loan servicer and tell them to revoke any power of attorney or third-party authorization agreements.

- Contact your bank or financial service to cancel any payments to any student debt relief companies.

- File a report of identity theft with the Federal Trade Commission; request assistance with a recovery plan.

- Submit a complaint with the Federal Student Aid Feedback System regarding suspicious activity.

Analysis: Institutional Dishonesty

The cohort default rate (CDR) according to the ED is “the percentage of a school’s borrowers who enter repayment on certain FFEL or Direct Loan Program loans during a particular federal fiscal year… and default or meet other specified conditions prior to the end of the second following fiscal year.” Schools with high cohort default rates can be sanctioned, lose eligibility to participate in federal loan programs, or have other consequences. Therefore, it is in an institution’s best interest to have low cohort default rates. Unfortunately, many colleges with high default rates try to lower the rates by abusing the forbearance option for loans. The forbearance option is meant for the benefit of the student, not the institution. In 2017, Navient, one of the largest student loan servicing companies in the US, was found to have collected $4 billion in interest charges incurred by multiple forbearance periods being used by borrowers.

Analysis: Dishonesty in Loan Servicing

Seventy percent of complaints about the companies servicing student loans are related to mismanagement and deliberate deception. Many students are unaware that they are eligible for income-driven repayment plans on federal loans as required by law and servicers frequently fail to assist them. Instead, borrowers are frequently placed in suspended payment options that rack up interest instead of income-driven repayment plans. Additionally, borrowers frequently enroll in plans their servicers tell them are eligible for Public Service Loan Forgiveness. They make payments for many years only to be denied when they apply because they were not enrolled in a qualifying repayment plan. Service providers also fail to explain that loan consolidation restarts the progress a borrower makes toward loan forgiveness.

- In 2015, less than 6% of eligible borrowers of FFELP loans were enrolled in income-driven repayment plans compared to nearly 30% of borrowers with loans made directly by the Department of Education.

- More than 20% of FFELP borrowers were delinquent or in forbearance.

- Federal student loan servicer Navient received 43% of federal servicer complaints.

- American Education Services and Pennsylvania Higher Education Assistance Agency received 24% of complaints.

- 10% of complaints were about Nelnet, 4% about Great Lakes, and 2% were regarding servicer Heartland Payment.

- 13,900 complaints were in regard to federal student loans, with the biggest percentage of complaints related to dealing with the lender or servicer.

- 6,700 complaints in regard to private loans, with the biggest percentage of complaints related to dealing with the lender or servicer.

- California (236) and New York (222) were the states with the most private student loan complaints.

- Common complaints included:

- Frequently misapplied monthly loan payments

- Lost documents

- Unreasonable processing delays

- Inappropriate denials of income-driven repayment plan applications

Report: Navient vs. ED

As of 2022, Navient is no longer contracted to service federal loans from the U.S. Department of Education.

In 2017, the Consumer Financial Protection Bureau (CFPB) sued Navient (formerly known as Sallie Mae), the largest student loan servicing company in the United States. Under a contract with the US Department of Education, this company services over $300 billion of federal and private student loans. CFPB alleged gross mismanagement, deceiving students and borrowers and depriving them of their legal rights.

- Failure to correctly apply or allocate payments made by borrowers.

- Pushed borrowers to pay more on loans than they could or pushed them into forbearance.

- Obscured information about maintaining lower payments.

- Deceived borrowers about requirements to release co-signer on their loans.

- Reporting loans that had been forgiven as in default, thereby effectively destroying the credit rating of students (including severely injured veterans) whose loans were forgiven or discharged under the Total and Permanent Disability discharge program.

- In 2019, the Consumer Financial Protection Bureau (CFPB) received over 20,000 complaints related to both federal and private loans, resulting in ongoing enforcement actions.

- Beginning in October 2017, the Federal Trade Commission (FTC), CFPB, US Dept. of Education, and state Attorney General offices announced “Operation Game of Loans” to pursue 36 enforcement actions against student debt relief companies in 11 states and District of Columbia:

- $95 million in illegal upfront fees scammed from student debtors.

- In 2018, the FTC secured judgments in 8 actions worth over $88 million, and in 2019, it secured judgments worth over $43 million.

- CFPB enforcement actions alone have obtained judgments exceeding $17 million.

Sources

- Board of Governors of the Federal Reserve System (Fed), Consumer Credit – G.19

- U.S. Department of Education (ED) Office of Federal Student Aid (OFSA), Federal Student Loan Portfolio

- ED, COVID-19 Emergency Relief and Federal Student Aid

- National Center for Education Statistics (NCES), The Integrated Postsecondary Education Data System

- Morning Consult National Tracking Poll #210134

- The College Board, Trends in Higher Education

- Enterval, Private Student Loan Report

- Fed, Report on the Economic Well-Being of U.S. Households

- NCES, Digest of Education Statistics

- ED, White House Initiative on Educational Excellence for African Americans

- U.S. Bureau of Economic Analysis, Data Tools

- ED OFSA, Avoiding Student Aid Scams

- Pew Research Center, 5 Facts About Student Loans

- U.S. Governement Accountability Office, Public Service Loan Forgiveness

- ED OFSA, Loan Forgiveness Reports