MEFA may be a good option for nongraduates who attended public or nonprofit private schools. MEFA is a nonprofit direct lender that works solely with education financing, charges no hidden fees, and recently lowered its rates.

| Loan Limits | $10,000+ |

| Fixed Rates | 6.20% – 8.99% |

| Variable Rates | None |

| Terms | 7, 10 or 15 years |

| Min. Credit Score | Undisclosed |

| Apply | Link |

Skip to: Rates & Fees | Eligibility Requirements | Repayment Options | Consumer Reviews & Complaints | FAQ

| Private student loans | ✓ |

| Private parent loans | ✓ (in parent’s name only) |

| Federal student loans | ✓ |

| Federal Parent PLUS loans | ✓ (in parent’s name only) |

MEFA Refinance Rates & Fees

The Massachusetts Educational Financing Authority (MEFA) offers fixed loan rates for student and parent refinance loans.

| Term | Fixed Rate |

|---|---|

| 7, 10, or 15 Years | 6.20% – 8.99% |

Additional information about MEFA refinance rates:

- Checking your rate with MEFA will not affect your credit score. They will conduct a soft, not hard, credit inquiry (learn the difference).

- MEFA does not offer a discount for setting up auto-pay.

MEFA refinance rates recent history:

In 2023, MEFA raised its lowest available fixed rate for new loans by 21.1% (from 4.75% APR). Meanwhile, its highest fixed rate went up 18.9% (from 7.15% APR).

In 2022, MEFA raised its lowest and highest fixed rates 90.0% and 25.4%, respectively.

Student Loan Refinancing Calculator

Based on advertised rates, use the calculator below to determine what your new monthly payment and potential savings may be if you refinance with MEFA.

Additional Fees

Beyond interest rates, there are a number of fees a refinance lender may charge up-front or during the loan servicing period. Below is a list of fees that MEFA does or does not charge.

| Fee Type | Amount Charged |

|---|---|

| Application Fee | None |

| Loan Origination Fee | None |

| Disbursement Fee | None |

| Prepayment Penalty | None |

| Late Payment Fee | None |

| Returned Payment Fee | None |

| Collection Fee | Not specified |

- Application fee – fee to apply for rates & approval.

- Loan origination fee – fee to create the new loan.

- Disbursement fee – fee for distributing funds to lenders to pay off loans that have been refinanced.

- Prepayment penalty – fee for making extra payments to reduce a refinance loan balance or pay it off early.

- Late payment fee – fee for making a late payment.

- Returned payment fee – fee for failed payments due to insufficient funds, also known as a “bounced check”.

- Collection fee – fee for collection activity on a defaulted debt; MEFA promises to “charge only those collection fees that are reasonable in relation to the cost of collecting the debt”.[1]

Current Promotions & Offers

MEFA is typical of many nonprofit lenders in that it does not offer special promotions or discounts.

MEFA Refinance Eligibility Requirements

To qualify for refinancing with MEFA, loans must be actively in repayment and must have been repaid on time in each of the previous 12 months. Additionally, all borrowers must meet the criteria below.

- Citizenship Requirement: U.S. citizenship or permanent residence.

- Income Requirement: $24,000 minimum income.

- Credit Score Requirement: undisclosed; borrowers must have an established credit history.

- Graduation Requirement: no graduation requirement.

- Location Requirement: none specified.

Additional restrictions apply for certain individuals and loans.

- Loans must have been used to attend an eligible, not-for-profit, degree-granting university as defined by MEFA.

- Borrowers must have no history of default on an education loan.

- No delinquencies on education debt in the past 12 months.

- No history of bankruptcy or foreclosure in the past 60 months (5 years).

MEFA Student Loan Repayment Options

Lenders vary greatly on the benefits and options provided to borrowers during the loan servicing period. Additionally, benefits may only be available on a case-by-case basis. MEFA does not offer any specific relief options.

Deferment & Forbearance

In the event that borrowers have difficulty making payments, MEFA appears to direct them to the company’s loan servicer, American Education Services (AES). AES offers relief under several conditions, nearly half of which allow for terms of deferment or forbearance due to economic hardship. See AES’s conditions for deferment and forbearance below. Note that MEFA does not claim to guarantee any of these terms.

| Condition | Coverage |

|---|---|

| Returning to grad school (half- or full-time basis) | Deferment |

| Disability rehabilitation | Not specified |

| Active military duty | Deferment or Forbearance |

| Involuntary unemployment | Deferment or Forbearance |

| Economic hardship | Deferment or Forbearance |

| Natural Disaster | Forbearance |

| Temporary Hardship | Forbearance |

Additional Options

MEFA may offer some opportunities to modify a refinance loan contract.

- Co-signer release is not available for MEFA refinance loans.

- Death / disability discharge is available in the unfortunate circumstance that a borrower passes away or suffers total permanent disability.

MEFA Reviews, Complaints & Lawsuits

Beyond our own findings, our team also collected the most genuinely insightful customer experiences we could find, including any instances of legal action against the company in which the details became public.

MEFA Online Reviews

Few MEFA customer reviews are readily available on public forums. We have included this material for its value as unedited, uncensored, and unsolicited user experience. Note that these reviews are unverified, may include inaccuracies, and may provide outdated information (about rates, bonus offers, etc.).

“I originally refinanced my loans about a year and a half ago and got a 4.37% fixed rate (with autopay) from LendKey. I’ve paid ~$18.5k in principal and ~$4k in interest since then, bringing my current balance to ~$56k. I decided to take a stab at refinancing again, and found MEFA via credible.

I was quoted a pre-qualification rate of 3.7% fixed for a 7 year term. I went through the actual application process and that’s the exact rate that I ended up getting. 10/10 recommend refinancing again if you have paid down a decent amount of principal or if you haven’t done it in awhile.” – eyelashchantel on reddit, 12/3/2019

“I just refinanced my [private loans] using MEFA last week. They will be serviced by AES Success. My [credit score] was 702 and I got 5.2% fixed rate (down from 12% variable from [another well-known lender], ugh). Maybe you’ll get a better rate now that it came down? [A large national bank] was my original PL service, and my variable rate was low, I think around 4%. When it was sold to Navient after 5 yrs, they jacked it up every month for 2 years.” – Countrygrlinthecity on reddit, 3/18/2020

More (unfiltered) customer reviews of MEFA are available at TrustPilot.com (4.7 of 5 rating).

MEFA Consumer Complaints

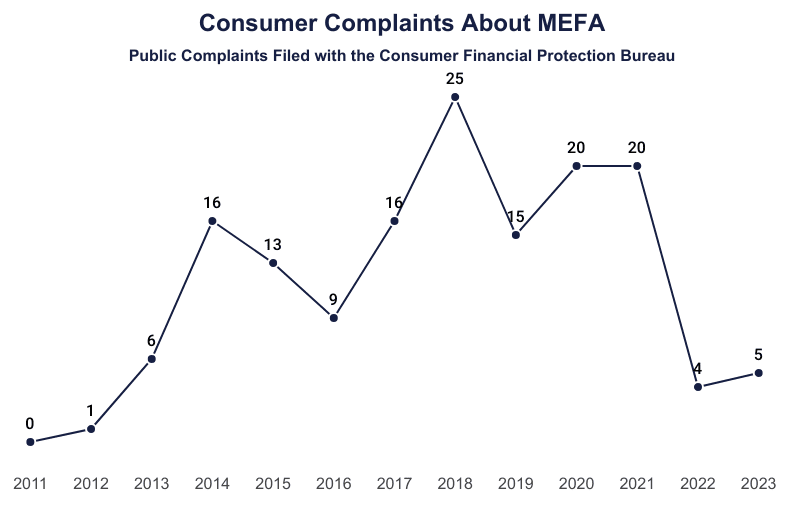

As consumer finance companies, student loan refinancing lenders fall under the jurisdiction of the Consumer Financial Protection Bureau (CFPB). As part of its mission, this federal agency allows consumers to log official complaints. These complaints are publicly available on the CFPB official website.

Since March 7, 2012, the CFPB has logged 145 complaints about Massachusetts Education Financing Authority (MEFA) at a rate of one (1) complaint every 26 days and 20 hours; that is more than twice the average daily complaint rate among reviewed lenders. Among 70 complaints that include narrative details, at least 14 or 20.0% specifically reference refinance.

In 2022, MEFA’s consumer complaint rate is 73.5% lower (as of this writing) than its complaint rate in an average year. In 2021, MEFA received 20 total consumer complaints, which is 47.0% more than its average annual rate.

Consumers file the average annual equivalent of one (1) complaint for every $933,088 estimated operating revenue or roughly one (1) complaint for every four (4) employees.

The allegations made in these complaints are unverified, are not necessarily representative of all consumers’ experiences with MEFA, and may contain outdated information (about rates, bonus offers, etc.). Note that a lender with a large customer base is likely also to have a higher number of complaints when compared with smaller lenders.

Below we’ve included three (3) of the most recent complaints (as of this writing) in which the consumer consented to share their details.

Complaint 5879984

8/15/2022

Texas

“My son and I applied for a refinance loan with MEFA. There was no assistance to understand their review. We submitted all of the documents required over a period of 60DAYS! We would receive a notice to submit another document, and we would submit it twice or three times after being asked to submit the same documents. No one could explain why we kept getting asked to resubmit what we had already submitted. We called the answering clerks at MEFA ( who never have any authority ) who could only say that the documents were submitted but waiting on the ” review ”. No one with management authority would come to the phone. We spent considerable time getting things to MEFA as requested and there was no supervisor to provide us any insight to why MEFA was having difficulty with the documents. Both my son and my credit scores are above 700 and we both make very comfortable wages. It is disgraceful the amount of time we spent on this 60 DAYS! and finally called to ask what was going on with the loan. Lady said it was rejected. No one even called or emailed any decision or explanation. AVOID THIS REFINANCE COMPANY OR YOU WILL WAIST CONSIDERABLE PERSONAL TIME!”

Complaint 5294077

3/7/2022

Ohio

“This complaint involves a Parent PLUS loan that was currently held by XXXXXXXX XXXX and serviced by XXXX XXXX. In XX/XX/2022, I refinanced this loan through MEFA, with loan servicing by XXXX. On XX/XX/2022 I received written notification from MEFA that it had disbursed the full payoff amount of {$62000.00} to XXXX on that date. As of XX/XX/2022, XXXX XXXX has not credited that payment to my account, and has indicated by telephone that it has no record of the payment that MEFA claims to have made. I have called MEFA ‘s customer service phone number ( XXXX ) five times : XXXX XXXX ( approx ) XXXX XXXX XXXX XXXX XX/XX/XXXX XX/XX/XXXX On each occasion, I explained the issue to the customer service rep, who has promised that the issue would be looked into and that someone would call me back. On the XXXX XXXX call, the customer service rep told me that MEFA would make direct contact with XXXX to track down the missing money. I have been unable to confirm whether that attempt was ever made. The only time MEFA has ever kept its promise to return a phone call was to verify my account number with XXXX after my initial call. Since then, MEFA has been non responsive. I have asked MEFA to provide me with the identifying information about the electronic payment it claims to have made, so I can attempt to track it down myself. They have been non-responsive to this request, too. As of XX/XX/XXXX, I have had to make two separate payments on the loan – one to XXXX and one to MEFA- to avoid late charges and a negative impact on my credit report. I’m not able to sustain making double payments. MEFA has put me in a vulnerable financial position by its own negligence and unresponsive customer service ; and it has failed to uphold its part of the loan agreement because there is no evidence it has ever paid the previous lender.”

Complaint 4942394

11/23/2021

Massachusetts

“There is no way that these companies investigated this student loan. The same information continues to report on my credit. I honestly don’t believe I was late and I don’t agree with the total balance that they are reporting on my credit. It continues to report several inaccuracies among the 3 credit reporting agencies from the last student loan company. How is that possible? For example, Each bureau reports that I was late on a different date Also, Hows it possible that youve reported me 90 days late with no late payments prior to that? Wasn’t XXXX sued by Cfpb before for not applying payments to consumers accounts correctly?”

For a full list of complaints made against MEFA in the CFPB’s Consumer Complaint Database, click here.

MEFA Lawsuits

While MEFA hasn’t faced any recent litigation, the organization has been the plaintiff in several collections lawsuits starting in 2019. Many of these suits are, in effect, “inactive” due to the current moratorium on federal student loan debt collection.[2]

Frequently Asked Questions

These are the most common questions consumers have about student loan refinancing with MEFA.

- Is MEFA good for refinancing student loans? MEFA may be a good option for nongraduates who attended public and/or nonprofit private schools and have an established credit history.

- Does MEFA have a minimum credit score requirement to refinance student loans?

MEFA may no longer have a minimum credit score requirement; previously, this lender listed a minimum credit score of 670 to qualify for student loan refinancing. Current requirements, however, only specify the need for an established credit history.

- Are MEFA loans federal? MEFA loans are not federal. MEFA has no affiliation with the federal government or the U.S. Department of Education.

- Does MEFA charge a prepayment penalty? There are no penalties for early payments or repaying a loan in full before its term is over.

- Does checking your rates with MEFA hurt your credit score? For their prequalification process, MEFA performs a soft credit check, which will not hurt your credit score. If you proceed with an application, however, MEFA will perform a hard credit check which may affect your credit score.

- Does MEFA charge a late fee? There are no penalties for late payments or returned payments.

- Is MEFA a bank? MEFA is not a bank nor is it affiliated with any bank. MEFA is a lender that deals solely in education loans.

- Can I refinance a MEFA loan? You can refinance a MEFA student loan or a student loan from another private lender. There is no limit to the number of times a borrower may refinance with MEFA. Note, however, that every new line of credit requires a hard credit check that may affect your FICO score.

- Can I refinance just some of my loans with MEFA? Yes, you can refinance some, all, or just one of your qualifying student loans with MEFA. You may choose to refinance your private loans only or refinance private and federal loans together.

- Can I refinance loans that have already been refinanced? Yes, you can refinance loans as many times as you want with MEFA. Note that each time you refinance, you will have to submit a new application; every application requires a hard credit check that may affect your credit score.

- Can my spouse and I refinance our loans together with MEFA? MEFA does not combine spouses’ student loan debts for refinancing unless the spouse is a co-signer on the original loan..

- How long does it take to refinance with MEFA? The entire process from prequalification until the day the first payment is due takes between 6 and 10 weeks. Conditional approval takes 10 to 15 minutes if you apply without a co-signer or co-borrower. Final review takes 10 to 14 days. Once you have accepted the loan terms and provided your e-signature, fund will be disbursed within the next 5 business days.

- Who services MEFA refinance loans? American Education Services (AES) services all MEFA loans.

- Does MEFA offer a grace period? MEFA refinance loans do not include a grace period.

- How often do variable rates change? MEFA no longer offers variable rates. Previously, MEFA adjusted its variable rates monthly according to the 1-Month LIBOR.

- What happens if I file for bankruptcy? According to MEFA, “filing for bankruptcy does not necessarily discharge refinance loans.”

- Does MEFA partner with any major student refinance lender marketplaces?

MEFA partners with Credible as part of its multilender marketplace. INvestEd also advertises MEFA as a featured lender.

Compare Student Loan Refinance Reviews

| Lender | Rating |

|---|---|

| RISLA | A+ |

| Brazos | A |

| Credible | A |

| Advantage | A- |

| ELFI | A- |

| Laurel Road | A- |

| Mpower Financing | A- |

| Splash Financial | A- |

| Purefy | B+ |

| UW Credit Union | B+ |

| LendKey | B+ |

| College Ave | B |

| PenFed | B |

| SoFi | B |

| Earnest | B- |

| EDvestinU | B- |

| INvestEd | B- |

| MEFA | B- |

| Sparrow | B- |

| Yrefy | B- |

| Citizens Bank | C+ |

| ISL | C+ |

| Lend-Grow | C+ |

| SELF Refi | C+ |

| SuperMoney | C+ |

| First Tech Federal | C |

| BECU | C- |

| Navy Federal | C- |

| iHelp | D+ |

| Nelnet Bank | D |

| PNC Bank | D- |

| NaviRefi | F |

Sources

- MEFA, Guiding Principles

- Law Office of Adam S. Minsky, Who is MEFA – Massachusetts Educational Financing Authority

- MEFA, Student Loan Refinancing

- MEFA, Refinance Loan Fixed Rate Loan Application and Solicitation Disclosure Effective 1.20.22

- MEFA, Refinance Loan Application and Solicitation Disclosure Effective 2011

- MEFA, Financial Statements with Management’s Discussion and Analysis and Supplemental Information June 30, 2019 and 2018

- Consumer Financial Protection Bureau, Consumer Complaint Database

- Dun & Bradstreet (DnB), Business Directory: Massachusetts Educational Financing Authority

- DnB, Business Directory: Massachusetts Higher Education Assistance Corporation

- Better Business Bureau, Search Businesses and Charities