CommonBond may be the best option for visa holders and for parents who want to transfer debt to a child. This for-profit marketplace lender services its own loans in-house though interest rates can be on the high side.

| Loan Limits | $5,000 – $500,000 |

| Fixed Rates | 2.72%* – 6.36% |

| Variable Rates | 2.72% – 6.36% (Unverified Cap) |

| Hybrid Rates† | 2.72% – 6.36% (Unverified Cap) |

| Terms | 5, 7, 10, 15, or 20 years |

| Min. Credit Score | 660 |

| Apply | Link |

*Lowest rates always include the 0.25% interest reduction for enrolling in auto-pay.

†Hybrid rates only available for 10-year term. Skip to: Rates & Fees | Eligibility Requirements | Repayment Options | Consumer Reviews & Complaints | FAQ

| Private student loans | ✓ |

| Private parent loans | ✓ (in either name‡) |

| Federal student loans | ✓ |

| Federal Parent PLUS loans | ✓ (in either name) |

‡Parents may refinance in their own name or tranfer debt to a child.

CommonBond Refinance Rates & Fees

Fixed rates with CommonBond, Inc. are between 2.72% and 6.36%. Variable rates are between 2.72% and 6.36%. CommonBond also offers a hybrid rate between 2.72% and 6.36% for a term of 10 years. Note that the lowest rates always include a 0.25% interest rate reduction for enrolling in automatic payments.

In 2022, CommonBond has raised its lowest available fixed rate for new loans 5.0% (from 2.59% APR) and reduced its highest fixed rate by 11.5% (from 7.19% APR). The lowest available variable rate has increased 38.1% (from 1.97% APR) while the highest variable rate is down 12.6% (from 7.28% APR). Hybrid rates are up by a combined average 36.2%.

| Term | Fixed Rate | Variable Rate |

|---|---|---|

| 5 Year | 2.72% – 6.36% | 2.72% – 6.36% |

| 7 Year | 2.72% – 6.36% | 2.72% – 6.36% |

| 10 Year | 2.72% – 6.36% | 2.72% – 6.36% |

| 15 Year | 2.72% – 6.36% | 2.72% – 6.36% |

| 20 Year | 2.72% – 6.36% | 2.72% – 6.36% |

Additional information about CommonBond refinance rates:

- Checking your rate with CommonBond will not affect your credit score. They will conduct a soft, not hard, credit inquiry (learn the difference).

- CommonBond does offer a discount for setting up auto-pay: 0.25% interest rate reduction.

- Variable rates are based on the 1-month LIBOR rate (4.14% as of this writing). This means that as the LIBOR changes, increasing or decreasing, your variable rate will change, increasing or decreasing correspondingly.

- No specified variable rate cap.

Student Loan Refinancing Calculator

Based on advertised rates, use the calculator below to determine what your new monthly payment and potential savings may be if you refinance with CommonBond.

Additional Fees

Beyond interest rates, there are a number of fees a refinance lender may charge up-front or during the loan servicing period. Below is a list of these fees that CommonBond does or does not charge.

| Fee Type | Amount Charged |

|---|---|

| Application Fee | None |

| Loan Origination Fee | None |

| Disbursement Fee | Undisclosed |

| Prepayment Penalty | None |

| Late Payment Fee | $10.00 or 5.00% of the overdue amount (whichever is less) |

| Returned Payment Fee | $5.00 |

| Collection Fee | Undisclosed |

- Application fee – fee to apply for rates & approval.

- Loan origination fee – fee to create the new loan.

- Disbursement fee – fee for distributing funds to lenders to pay off loans that have been refinanced.

- Prepayment penalty – fee for making extra payments to reduce a refinance loan balance or pay it off early.

- Late payment fee – fee for making a late payment. CommonBond presumably charges a late payment fee for any payments received beyond their due date.

- Returned payment fee – fee for failed payments due to insufficient funds, also known as a “bounced check”.

- Collection fee – fee for collecton activity on a defaulted debt.

Current Promotions & Offers

CommonBond offers a 0.25% interest rate reduction for enrolling in automatic payments. Refinance borrowers may also be eligible to participate in CommonBond’s referral program. A PayPal account is required to receive any referral bonuses. Other restrictions apply.

CommonBond Refinance Eligibility Requirements

To qualify for refinancing with CommonBond, all borrowers must meet the criteria below.

- Citizenship Requirement: U.S. citizenship or permanent residence -OR- certain visas with a qualified co-signer.

- Income Requirement: proof of income, no minimum specified.

- Credit Score Requirement: 660 minimum.

- Graduation Requirement: bachelor’s degree or higher.

- Location Requirement: available in 48 states (excluding Nevada and Mississippi) and Washington, D.C.

Additional restrictions apply for specific individuals and loans.

- Valid H1-B, J-1, E-2, and E-3 visa holders may apply with a qualified co-signer.

- Further restrictions may apply for residents of Michigan, Rhode Island, and Washington.

CommonBond Student Loan Repayment Options

Lenders vary greatly on the benefits and options provided to borrowers during the loan servicing period. Additionally, benefits may only be available on a case-by-case basis. CommonBond offers some relief options.

Deferment & Forbearance

CommonBond offers up to 24 months of forbearance over the life of a refinance loan, primarily for financial hardship. Their coverage is loosely defined, but their terms are flexible. See CommonBond’s conditions for deferment and forbearance below.

| Condition | Covereage |

|---|---|

| Returning to grad school | Undisclosed |

| Disability rehabilitation | Undisclosed |

| Active military duty | Undisclosed |

| Involuntary unemployment | Forbearance, up to 24 months |

| Natural Disaster | Forbearance, single month terms |

Additional Options

CommonBond may offer other opportunities for relief or contract modification.

- Unexpected expenses and income reduction forbearances are available; CommonBond does not define terms.

- Co-signer release is available after 36 consecutive qualifying payments.

- Death / disability discharge is available in the unfortunate circumstance that a borrower passes away or suffers total permanent disability as defined by the Social Security Administration.

CommonBond Reviews, Complaints & Lawsuits

Beyond our own findings, our team also collected the most genuinely insightful customer experiences we could find, including any instances of legal action against the company in which the details became public.

CommonBond Online Reviews

Below are 3 samples of CommonBond customer reviews we found on public forums, included here for their value as unedited, uncensored, and unsolicited user experiences. Note that these reviews are unverified, may include inaccuracies, and may provide outdated information (about rates, bonus offers, etc.).

“I refinanced through Common Bond. $180,000 at 6.55% to 3.36% (with the auto debit discount). That’s roughly $16,000 less in interest payments over the life of the loan vs what Uncle Sam offered me.

I could have gone slightly lower with a variable rate but the Fed is going to slowly ratchet up that rate over the next few years if the economy keeps going well.” – PT on White Coat Investor, 9/29/2018

“I refinanced $150K grad school debt with CommonBond (got slightly better rate than [Lender X]). (I think [Lender X] and CommonBond are the most common private lenders for this….and it’s worth seeing what rate each will give you. If you meet the qualifications, [Lender Y] will give you the best rate to my knowledge, though there are logistical hoops to jump through.) I refinanced again with CommonBond after a year. I was 99% certain I would never need the federal protections…losing them is the only downside I see.” – cosmonaut on BogleHeads.org, 12/5/2017

“In my experience with CommonBond, refinancing was part of the transfer process. My mother had several ParentPLUS loans taken out between my siblings and me (5 kids total, around 10 loans totaling over $120k). My siblings and I had actually been paying towards the loans via subaccounts under my mom’s main account-/In general we all wanted to help pay back these loans that ultimately benefitted our education.

Eventually, one of my sisters refinanced (thru [Lender X]) first, and took about $30k in loans from a couple of the loans. It was a pretty easy experience from what I heard. I refinanced later thru CommonBond ([Lender X] rejected me for some reason), taking around $35k between 1 full loan and 1 partial loan. CommonBond was good about letting me list which loans I wanted to refinance (I was looking to take the higher % rates loans because my CommonBond % rate was a good amount lower). I don’t know if sofi required a signature from my mom to refinance to my sister, but CommonBond did require one. The process was not complicated and we were able to do it all online.” – marciepryon reddit, 9/9/2017

More (unfiltered) customer reviews of CommonBond are available at TrustPilot.com (3.2 out of 5) and ConsumersAdvocate.org (4.1 out of 5).

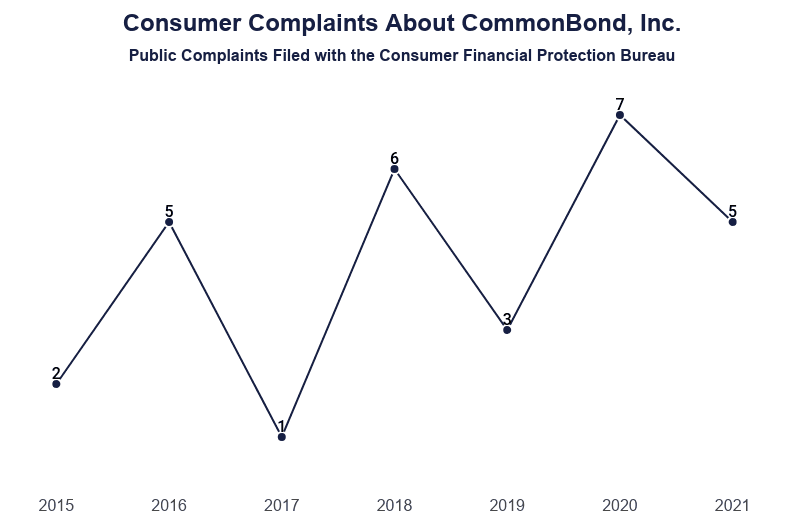

CommonBond Consumer Complaints

As consumer finance companies, student loan refinancing lenders fall under the jurisdiction of the Consumer Financial Protection Bureau (CFPB), a federal agency. As part of its mission, the CFPB allows consumers to log official complaints. These complaints are publicly available on the CFPB official website. Since September 2016, consumers have submitted 37 complaints about CommonBond, Inc. (CommonBond) to the CFPB for an average of one (1) complaint every 68 days and 11 hours; this is 19.9% lower than the average daily complaint rate among reviewed lenders.

Among the 21 complaints with narratives, 13 or 61.9% specifically refer to student loan refinancing.

In 2022, the average complaint rate is up 80.1% (as up this writing) compared to the complaint rate in an average year. In 2021, the annual complaint rate was 6.22% lower than average.

In 2021, CommonBond averaged one (1) complaint for every $1.194 million in reported corporate revenue or roughly one (1) complaint for every 13 employees.

The allegations made in these complaints are unverified, are not necessarily representative of all consumers’ experiences with CommonBond, and may contain outdated information (about rates, bonus offers, etc.). Note that a lender with a large customer base is likely to also have a higher number of complaints when compared with smaller lenders.

Complaint 5742654

7/6/2021

Illinois

“On XX/XX/2022 I applied as was approved for and signed for a loan. At this point, the loan was sent to my school ( XXXX ) for certification ( email attached ) In XX/XX/2022 CommonBond exited the student loan industry. I was concerned that my loan would not be funded given the rising interest rate environment. On XX/XX/2022 I reached out to the company to ensure my loan would be funded. On XX/XX/2022 the company affirmed that since the loan was approved pre-exit it would be funded as soon as my school certified the loan ( email attached ) On XX/XX/2022 my cost of tuition was certified by my school and and I received a ” Welcome to the Family ” email from Commonbond ( emails attached ). However, upon trying to access my documents on the CommonBond website, I am taken to a page stating they are no longer providing student loans with a link to a partner. I reached out to CommonBond for clarification and they not state they are no longer able to disburse my loan even though my school has disbursement dates confirmed in their system ( emails attached ). I believe this violates UDAAP regulations as it will cause me substantial harm without funding and with potentially higher costs, I forwent rate shopping based on their approval and more importantly the explicit promise of disbursement, and I was not reasonably able to avoid these injuries due to their assurances”

Complaint 5481261

4/21/2022

Georgia

“These XXXX companies need to better regulated as they are using a lot of bait and switch tactics to lure consumers in and then quickly change up the pricing/rate on people. With Commonbond, I sought them to refinance my student loans currently with XXXX. I went through filled out their application with the correct information, they did a soft pull of my credit and offered me a rate of 4.15 % for 20 years, in which I was elated because I am currently paying 5.235 % with XXXX and that reduced by rate by more than XXXX and would shave almost {$120.00} dollar off my current payment amount. Submitted my paystubs, connect my XXXX loan so they were able to see the rate and current amount, and commonbond proceeded did a hard pull of my credit. As of this morning, for the same 20 year loan, the rate has now jumped up to 6.3 %. I have high income, excellent credit, and low DTI. Ive never been late on any bill or my student loans. While most folks loans are deferred and not paying, since mine are private I have been consistently paying on-time during this COVID environment. So I do not understand why I was originally quoted 4.15 % and now being shown 6.3 %. All information provided was accurate and I provided my paystub to support the income I provided. I feel that if I were of XXXX decent and not XXXX XXXX, my rate would be still 4.15 %. These companies have been allowed to skirt many of the rules put in place to avoid skeptical business dealings and enforced with banks and it is about time they fall under the same rules. They should no longer be allowed be loose pitbulls.”

Complaint 5102737

1/11/2022

Minnesota

“I was approved for a refinance student loan in XXXX of 2021. According to Commonbond, that loan was disbursed on XX/XX/2021. However, my previous lender has not yet received a disbursement check and has continued to expect payment. According to Commonbond, they issued a check but it was returned. I was not informed of this until XX/XX/2021. Rather than contacting the lender for an explanation, Commonbond sent me an email requesting the mailing address on that date. I did not see the email until later when I was charged again for both loans. I sent my response with the address provided by my previous lender on XX/XX/2021. I did not receive a response to my email. I contacted Common bond on XX/XX/2021 to confirm receipt of my email. They confirmed that the email was received and that a second check had not yet been issued. The representative said that he would forward this issue to his supervisor and would send an update the next day via email. I did not receive an email. I called again on XX/XX/2021 and was told that the representative had no additional information and would follow up with me later that day. I did not receive a call or an email with more information. I called again on XX/XX/2021 and was informed that a second check was not yet issued and that the representative had no information to share and could not provide an accurate estimate of a response time. I requested that further steps be taken to ensure that this issue is resolved. They declined to take further action and repeated the offer to follow-up with an email. Throughout this time, Commonbond has required payment of this loan despite not paying off the original loan. This has resulted in double payment for several months. It is unacceptable that their customer service representatives do not follow-up on their commitments to address this issue It is also unacceptable that they do not have any information to share when reached by phone.”

For a full list of complaints made against CommonBond in the CFPB’s Consumer Complaint Database, click here.

CommonBond Lawsuits

Aside from a creative dispute with Laurel Road (the case was ultimately dismissed), CommonBond has not been subject to any significant legal action.

Frequently Asked Questions

These are the most common questions consumers have about student loan refinancing with CommonBond.

- Is CommonBond good for refinancing student loans? CommonBond may be the best refinancer for visa holders, who have few options when it comes to refinancing their student loans.

- Does CommonBond require a minimum credit score? Yes, borrowers must have a credit score of 660 or higher in order to refinance their student loans with CommonBond.

- Does checking your rates with CommonBond hurt your credit score? For their prequalification process, CommonBond performs a soft credit check, which will not hurt your credit score. If you proceed with an application, however, CommonBond will perform a hard credit check which may affect your credit score.

- Who services CommonBond loans? CommonBond Lending, LLC services CommonBond loans. Both are subsidiaries of CommonBond, Inc.

- Are CommonBond loans federal? CommonBond loans are not federal. CommonBond is a private lender and has no affiliation with the federal government or the Department of Education.

- Is CommonBond a bank? Commonbond is not a bank; it is a private lender.

- Can I refinance a CommonBond loan? You can refinance any kind of student loan. There is no limit to the number of times a borrower may refinance with CommonBond. Note, however, that every application requires a hard credit check that may affect your credit score.

- Does CommonBond charge a fee for prepayment? CommonBond does not charge fees or impose any pentalties for making extra loan payments or paying off your loan before the end of the term.

- Does CommonBond offer a grace period? CommonBond does not offer a grace period but does allow a grace period deferment if you graduated this year and your current student loans are already in a period of deferment.

- Does CommonBond charge late fees? For late payments, CommonBond charges $10.00 or 5.00% of the overdue amount (whichever is less).

- How long does it take to refinance with CommonBond? From the time you submit your application to the first repayment due date, it usually takes 7 weeks but may take as long as 14 weeks.

- What is CommonBond’s hybrid rate? CommonBond offers a hybrid APR. For borrowers who select this option, the first 60 payments will have a fixed rate while the last 60 payments have a variable rate. Hybrid rates are only available for terms of 10 years.

- Does CommonBond offer income-based repayment plans? CommonBond does not offer income-based repayment. Current borrowers may apply for up to 24 months of hardship forbearance, during which time their refinance loan continues to accrue interest.

- Can I refinance just some of my loans with CommonBond? You can refinance some, all, or just one of your qualifying student loans with CommonBond. You may choose to refinance your private loans only or refinance private and federal loans together.

- Can I refinance loans that have already been refinanced? You can refinance loans as many times as you want with CommonBond. Note that each time you refinance, you will have to submit a new application; every application requires a hard credit check that may affect your credit score.

- Besides the rate reduction for autopay, can I get any special rates or discounts with CommonBond? CommonBond partners with certain organizations to offer their employees, members, and their families special terms or one-time exclusive offers. Check with your organization to find out if they are a CommonBond partner or google “CommonBond x [your employer’s name]”.

- Does CommonBond partner with any major student refinance lender marketplaces?

Yes, CommonBond partners with Credible as part of its refinance lender marketplace. SuperMoney also advertises CommonBond among its marketplace lenders.

Compare Student Loan Refinance Reviews

| Lender | Rating |

|---|---|

| RISLA | A+ |

| Brazos | A |

| CommonBond | A |

| Credible | A |

| Advantage | A- |

| ELFI | A- |

| Laurel Road | A- |

| Mpower Financing | A- |

| Splash Financial | A- |

| Purefy | B+ |

| UW Credit Union | B+ |

| LendKey | B+ |

| College Ave | B |

| PenFed | B |

| SoFi | B |

| Earnest | B- |

| EDvestinU | B- |

| INvestEd | B- |

| MEFA | B- |

| Sparrow | B- |

| Yrefy | B- |

| Citizens Bank | C+ |

| ISL | C+ |

| Lend-Grow | C+ |

| SELF Refi | C+ |

| SuperMoney | C+ |

| First Tech Federal | C |

| BECU | C- |

| Navy Federal | C- |

| iHelp | D+ |

| Discover | D |

| Nelnet Bank | D |

| PNC Bank | D- |

| NaviRefi | F |